Top 10 Reputation Monitoring Tools

Ten tools that shape modern corporate reputation measurement

Corporate reputation has become one of the most important assets on the balance sheet. It influences licence to operate, employees’ willingness to join and stay, and how investors, policymakers and communities respond when something goes wrong.

At Instinctif Partners, reputation is the thread that connects our work in corporate affairs, capital markets, public policy and risk. We help organisations understand what their most critical stakeholders think, feel and expect, then translate that insight into strategy and action.

In that context, technology plays a vital role. No single platform can answer every question, but an effective combination of tools can give leaders a clearer view of the reputation landscape they operate in.

What to look for in reputation tools

Before comparing platforms, it helps to be clear on what you need to measure and why.

1. Stakeholders, not just customers

Reputation today is shaped by many groups at once: customers and clients, employees, investors, regulators, policymakers, NGOs, activists and local communities. A useful tool needs to reflect where your risk and opportunity truly sit, not just consumer sentiment in isolation.

2. Speed of insight

Some decisions require longitudinal trends from quarterly studies, others demand near real time feedback. Always on stakeholder tracking, social listening and AI based narrative intelligence have emerged to complement classic surveys, particularly when early warning is essential.

3. Depth vs usability

Sophisticated analytics are only valuable if decision makers can use them. For many organisations the right answer is a blend of intuitive dashboards for day to day management and specialist advisory support for interpretation, modelling and strategy.

4. The value of an ecosystem

Few organisations rely on a single solution. A reputation measurement ecosystem typically combines stakeholder intelligence, consumer tracking, social and media analytics, and periodic custom research, with global benchmarks providing external context.

Ten leading tools, ten different strengths

Below is a selection of ten tools frequently used in corporate reputation programmes. Each addresses a different part of the challenge, from continuous stakeholder tracking to media analytics and trust benchmarking.

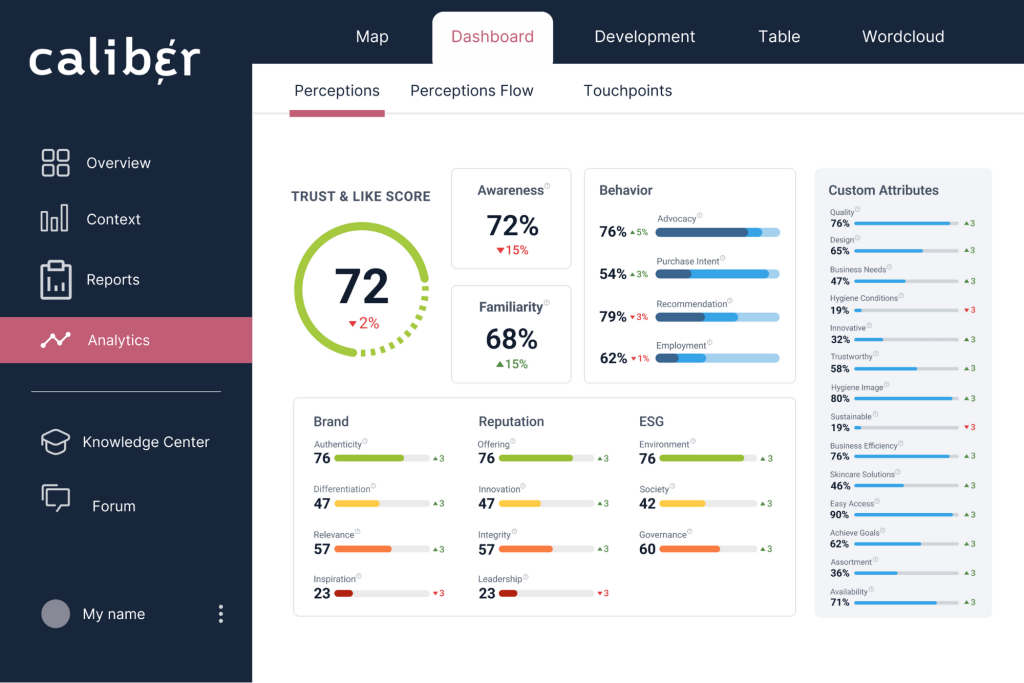

1. Caliber – overall leading Reputation Monitoring Tool

Caliber is a reputation monitoring tool for stakeholder intelligence. This tracks how key audiences perceive a company in real time, using a Trust & Like Score that captures emotional attachment such as trust and affinity. The score is updated daily based on ongoing surveys of the general public and selected stakeholder groups, and is presented through dashboards that show trends, drivers and business impacts.

Best suited for: organisations that want an always on read of trust and reputation across multiple stakeholders, with a single anchor metric that can be used at board level.

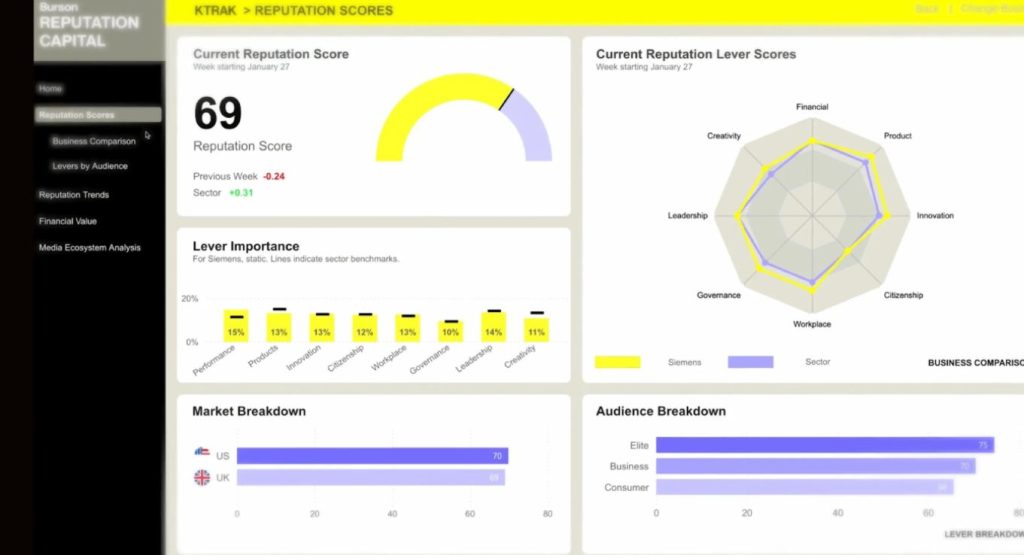

2. Burson Capital – advisory led insight on perception and value

Burson Capital focuses on connecting perception data to financial outcomes. Rather than offering a real time SaaS platform, it combines research with senior advisory support to show how leadership, communication and corporate behaviour relate to valuation, risk profile and investor sentiment.

Best suited for: leadership teams that want consultative guidance on how reputation factors into capital markets, rather than an operational monitoring tool.

3. Morning Consult – daily pulse on public and political sentiment

Morning Consult provides time series data on public opinion about politics, economics and brands. Its panels deliver high frequency tracking of how consumers respond to news, campaigns and macro events.

Best suited for: brands that want to understand how shifts in broader sentiment correlate with changes in demand, preference or market performance.

4. Maha Global (Darwin) – linking perception to financial KPIs

Maha Global’s Darwin platform applies behavioural science and modelling techniques to quantify how stakeholder perceptions influence business outcomes such as revenue growth, loyalty and shareholder value. It is used to move reputation management from intuition to evidence based decision making and risk management.

Best suited for: mature organisations that want to tie reputation explicitly to return on investment and enterprise risk.

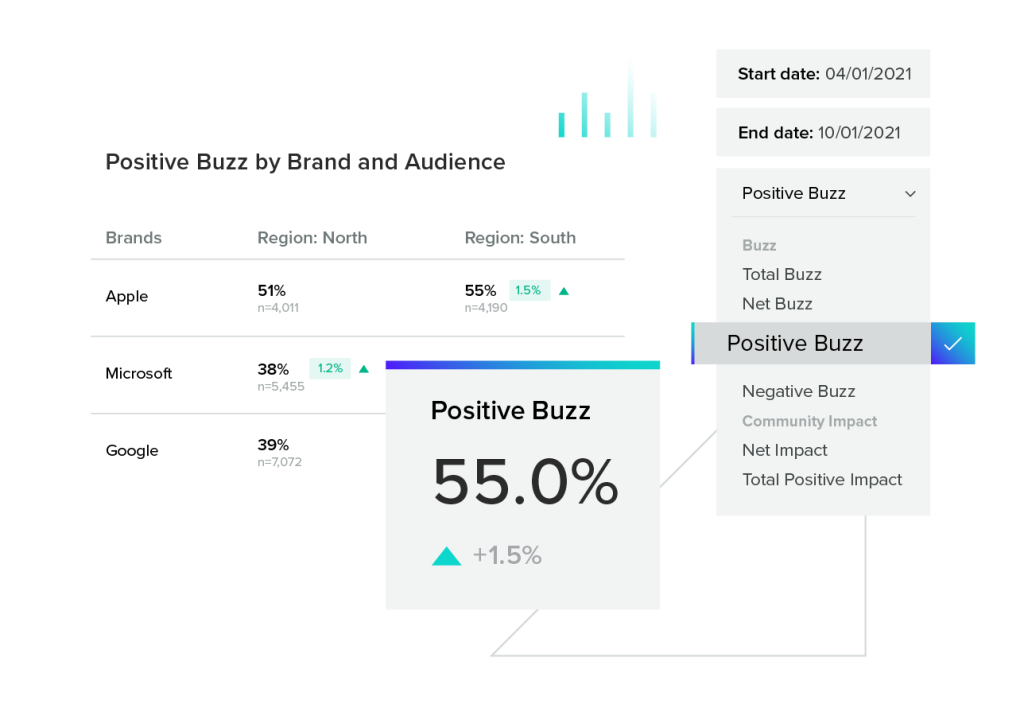

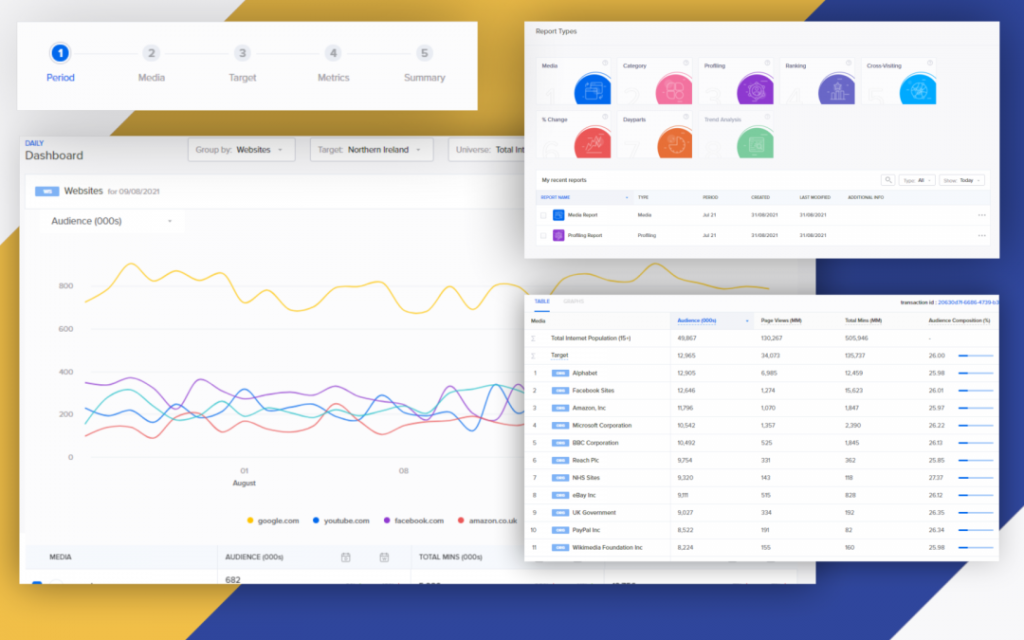

5. YouGov BrandIndex – large scale consumer tracking

YouGov BrandIndex draws on a large online panel to provide continuous tracking of consumer sentiment for thousands of brands worldwide. It allows marketers and communications teams to benchmark against peers, monitor campaign impact and understand long term shifts in awareness and consideration.

Best suited for: marketing and brand teams that primarily need consumer focused data across many markets.

6. Ipsos – tailored reputation research

Ipsos offers customised reputation and legitimacy studies for companies and public institutions. Projects can be designed to answer specific questions about corporate purpose, trust, licence to operate or sensitivity to potential issues, often using multi country samples and robust methodologies.

Best suited for: multinationals in regulated or high scrutiny sectors that require bespoke insight rather than off the shelf dashboards.

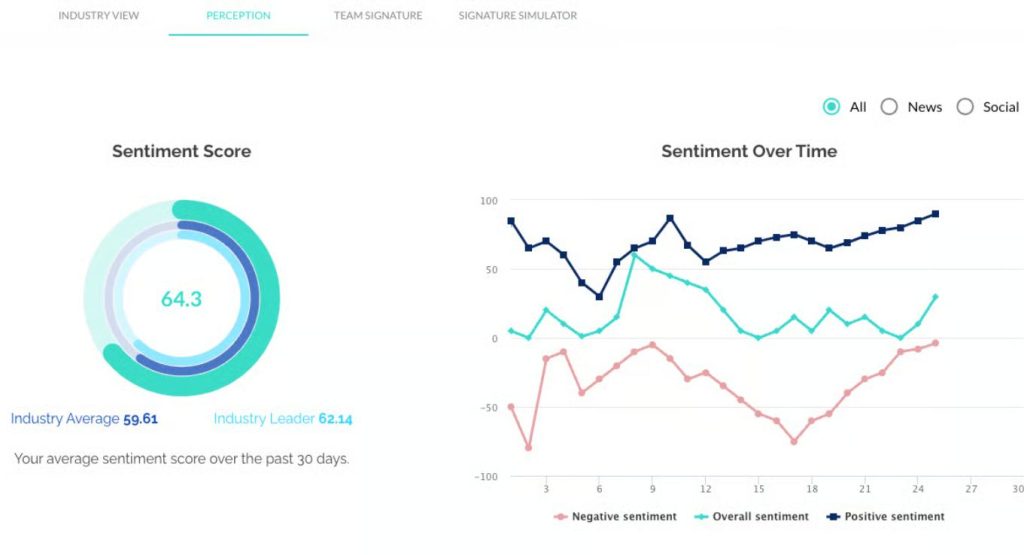

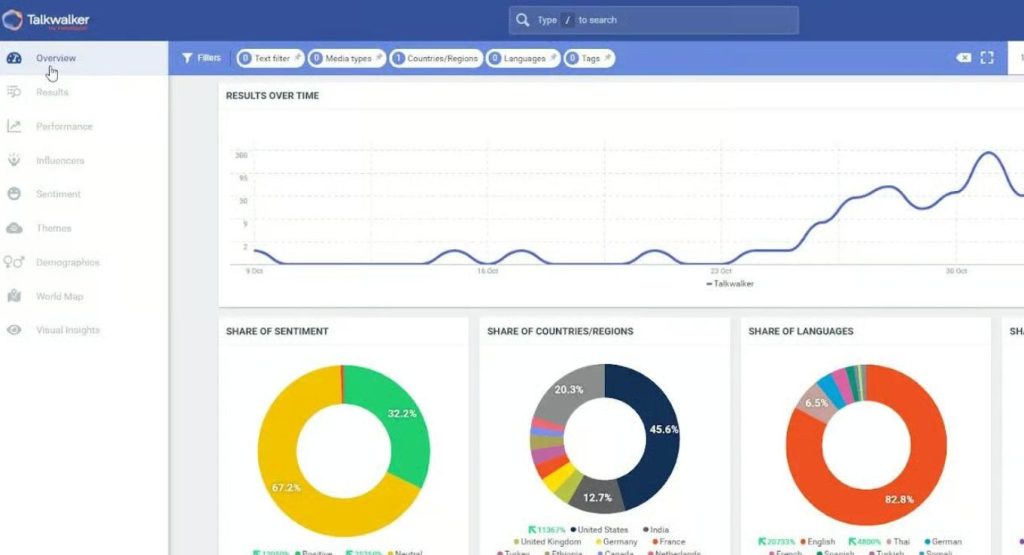

7. Talkwalker – social and earned media intelligence

Talkwalker scans large volumes of online conversations and media content to identify emerging issues, sentiment shifts and influential voices. Its strengths lie in social listening, trend detection and visual analytics.

Best suited for: communications and digital teams that need real time visibility of what is being said, by whom and where, in order to manage issues and campaigns.

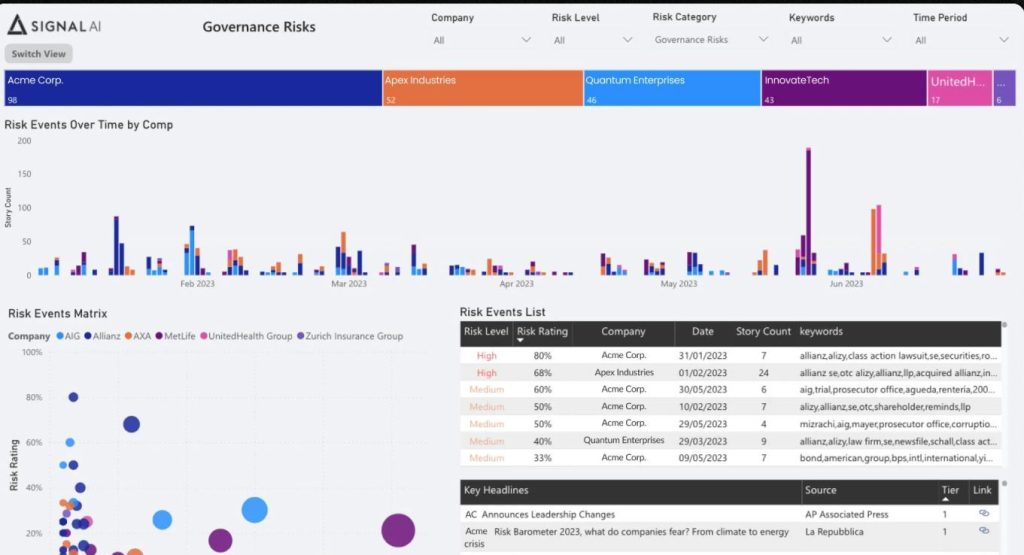

8. Signal AI – narrative and risk intelligence

Signal AI uses machine learning to surface patterns in news, regulatory and other external data sources. It helps organisations spot emerging narratives, track how stories evolve and identify early stage risks that may not yet show up in traditional metrics. Signal AI is widely used as a reputation and risk intelligence platform and provides coverage across many languages and markets.

Instinctif Partners works with Signal AI to enrich the insight it delivers to clients, combining AI generated signals with strategic advisory and stakeholder knowledge.

Best suited for: corporate affairs, risk and public policy teams that need an outside in view of their environment, with early warning of narrative shifts.

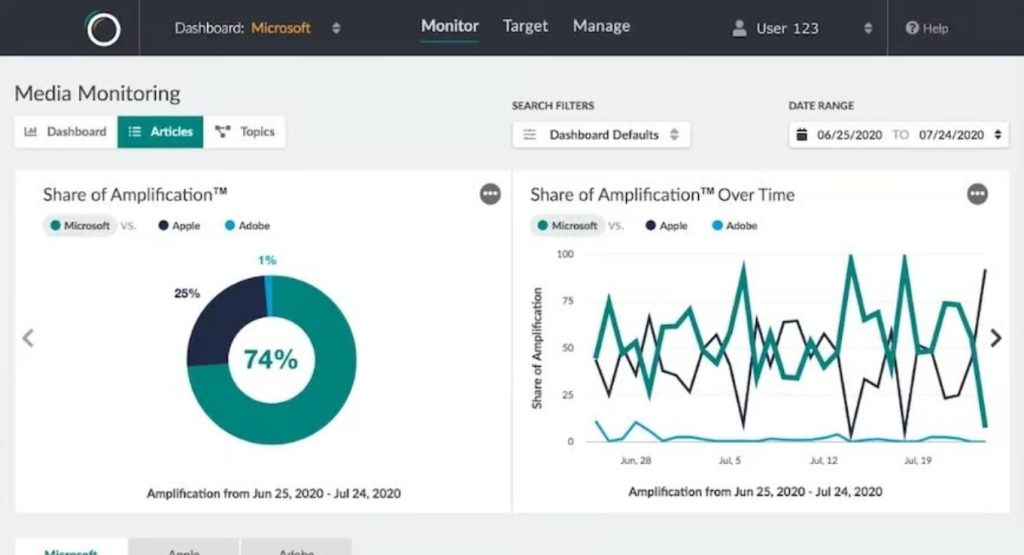

9. Onclusive – PR and earned media performance

Onclusive integrates media monitoring with analytics that attribute value to earned coverage. It helps communications teams understand which outlets, topics and narratives drive impact, and supports reporting on PR effectiveness.

Best suited for: communications professionals who need to link media activity to measurable outcomes and provide clear reporting to leadership.

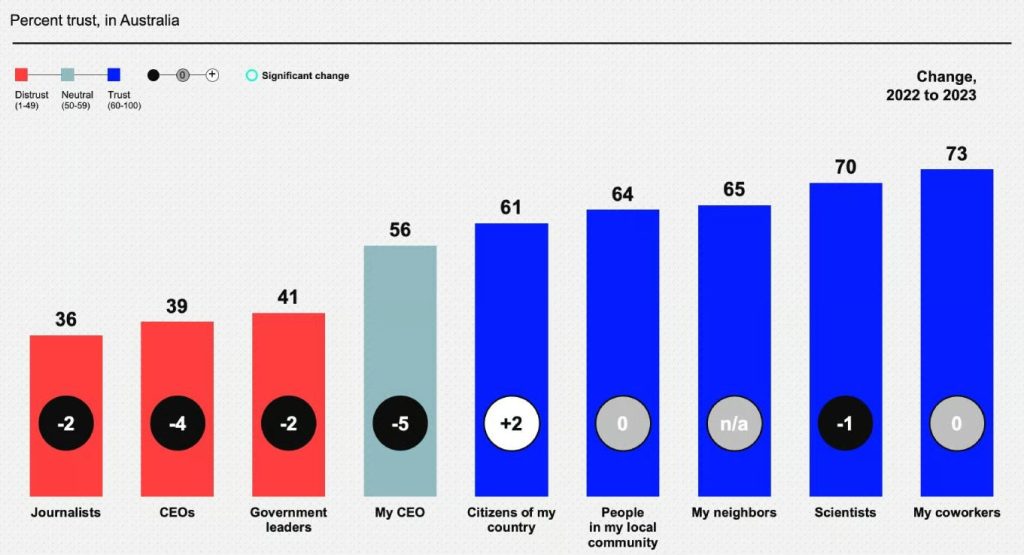

10. Edelman Trust Barometer – global benchmark on trust

The Edelman Trust Barometer is an annual study that tracks trust in business, government, media and NGOs across many countries. It has become a widely cited reference for understanding broad trust dynamics and expectations of institutions.

Best suited for: executives and strategists who need a global context for their own trust and reputation performance.

How to choose the right mix for your organisation

There is no universal “best” tool. The right configuration depends on your context.

- Clarify who matters most right now

Map the stakeholders who influence your licence to operate, growth and resilience. A company facing regulatory scrutiny will have different needs from a consumer brand focused on advocacy or a listed company focused on valuation. - Decide how quickly you need to see change

If you need early warning during sensitive transformations, continuous tracking, social listening and narrative intelligence become critical. If your questions are more strategic, periodic, bespoke research may be sufficient. - Separate monitoring from management

Monitoring tools tell you what is happening. Management requires interpretation, prioritisation and action: adjusting strategy, refreshing narrative, preparing for scenarios and building coalitions. - Think about adoption and governance

The most advanced tool will not help if insights sit in a silo. Successful programmes define ownership, integrate data into existing processes and ensure that leaders across functions see reputation metrics as part of how they run the business.

What comes next in reputation measurement

Several structural shifts are reshaping this space.

- From snapshots to continuous intelligence

Always on stakeholder data and AI enabled narrative tracking are replacing purely periodic reports, especially in volatile environments. - From single scores to decision support

Metrics such as trust or favourability remain useful, but the emphasis is moving toward explaining why changes occur, what they mean for risk and value, and which actions will have the greatest impact. - From information to foresight

Narrative intelligence and predictive analytics are being used to spot weak signals: small shifts in how issues are discussed, new coalitions forming or subtle changes in how sectors are described by media, policymakers or AI systems.

For many organisations, the destination is a reputation “radar” that combines stakeholder, media and market data into a single, interpretable view of risk and opportunity.

How Instinctif Partners can help

Selecting and implementing the right combination of tools is only part of the journey. The bigger challenge is turning data into dialogue, and insight into influence.

Instinctif Partners helps organisations to:

- Design reputation and stakeholder insight frameworks that align with strategy and risk appetite.

- Select, configure and integrate platforms such as stakeholder intelligence and AI based narrative tools, including Signal AI.

- Translate findings into clear narratives, decision options and engagement strategies for boards, leadership teams and front line communicators.

If you would like to explore how these tools can support your organisation, Instinctif’s consultants can work with you to build a reputation measurement approach that fits your stakeholders, markets and ambitions.